On the go? Listen to a voice recording:

Reading time: 13 minutes

Published: 2023 | Author: Anne Casey

After the aftermath of the COVID-19 pandemic, the consumer landscape for the Chinese has changed, not only in China, but also how it has impacted the Chinese in New Zealand. It is crucial for businesses looking to tap into this growing and influential market to keep up to date and informed.

As a digital marketing agency, our marketing consultants have extensively researched and analysed the latest post-COVID trends, to bring you a comprehensive overview for 2023. This includes insights into the evolving Chinese social media preferences and online habits to equip businesses to effectively connected with Chinese in China and those living in NZ.

Dominance of WeChat:

Despite a slowdown in the growth of WeChat in China, it remains the dominant and most popular platform among Chinese consumers. This is not only for Chinese living in China, but also for those based in NZ and overseas. WeChat, developed by Tencent, is a versatile mobile app that integrates messaging, social media, and mobile payment services.

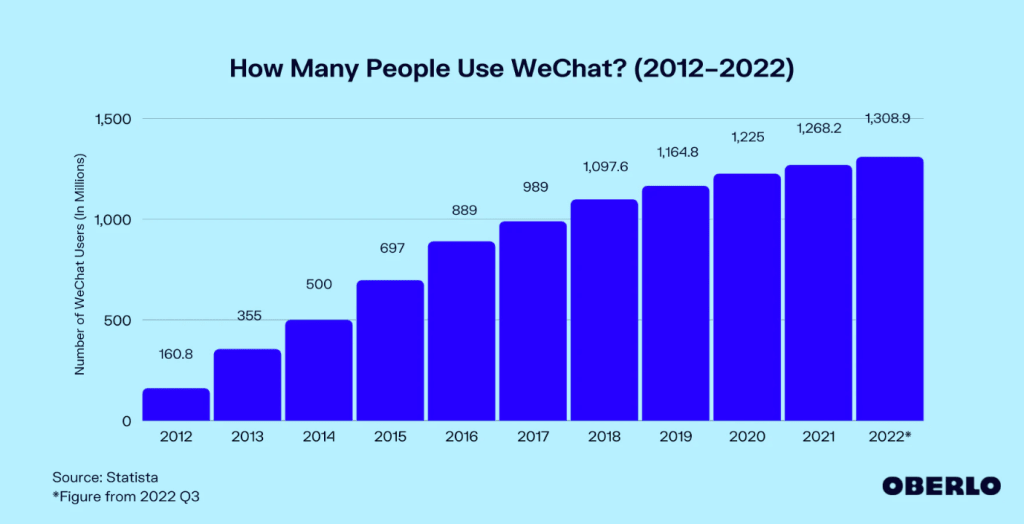

According to Statista, a leading platform for data and market research, WeChat draws 1.3 billion users in 2022 (see fig 1). This is more than the population of Europe and Russia combined!

FIG. 1:

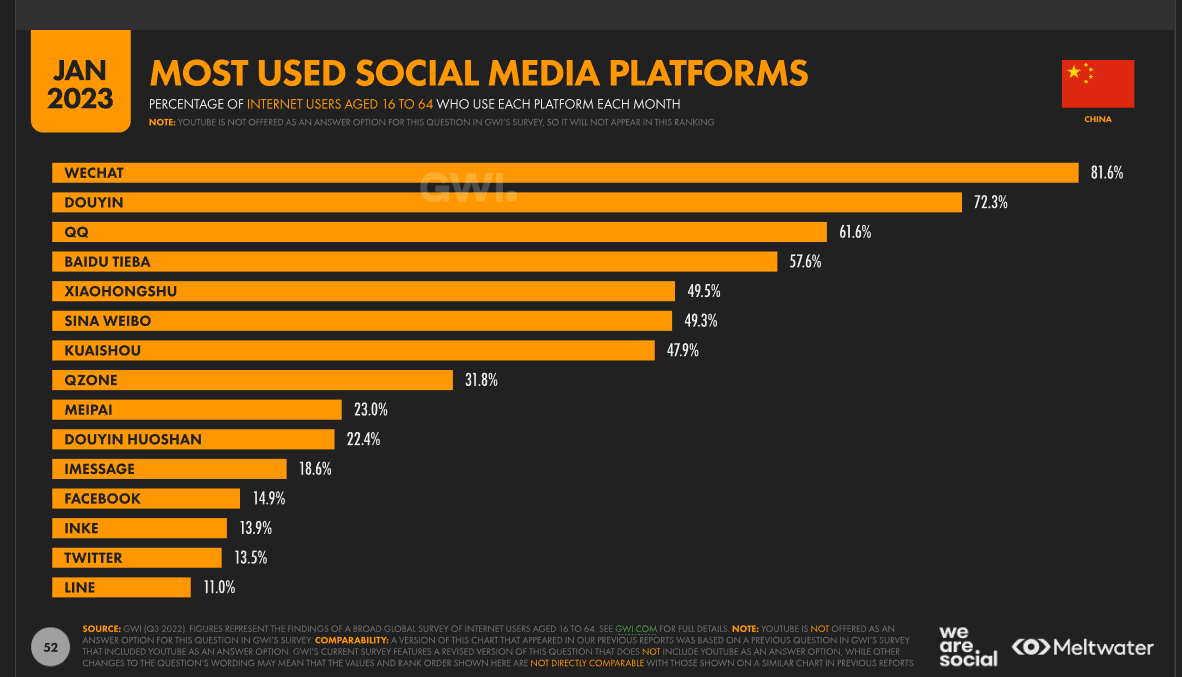

With a staggering 81.6% of internet users aged 16-64 using it monthly (see fig 2) WeChat continues to be indispensable as part of daily life for many users. This is almost 10% higher than the next social media application, Douyin at 72.3%. (We will discuss Douyin later on).

FIG. 2:

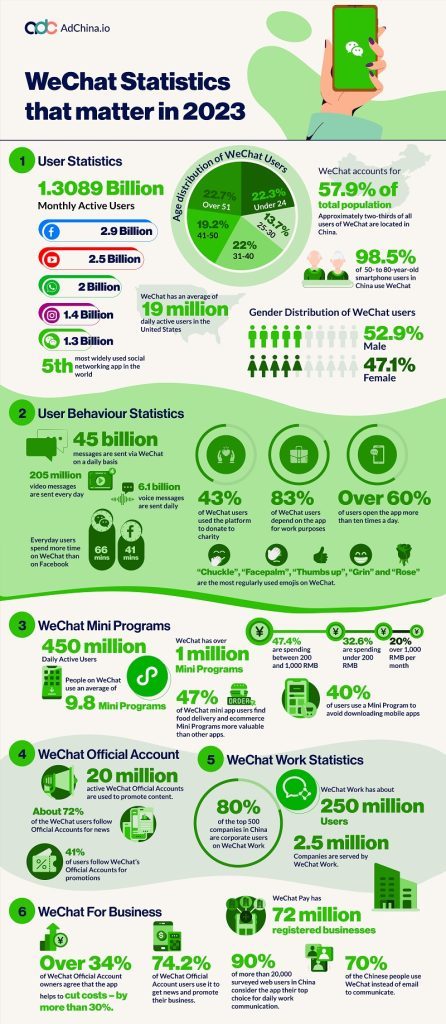

Users in China are spending an average of 66 minutes per day on WeChat, and its impressive 7-day retention ratio of 98.3%. underscores its enduring popularity. Furthermore, over 60% of WeChat users open the app more than 10 times a day, highlighting the high engagement rate of the platform. (See figure 3).

At the end of the day, all the stats and research that we found are pointing towards the fact that WeChat is here to stay and with a continued dominance hold on the Chinese.

FIG 3:

With regards to the usage of WeChat in New Zealand, there is limited publicly available information. Insights from our conversations with our network of researchers specialising in researching Chinese in New Zealand, along with anecdotal observations, we believe that the popularity of WeChat does carry over into New Zealand. This is true, especially with recent migrants, Mandarin is their first language and they want to stay connected to family and friends in China, and be kept up to date with news from China.

The Rise of Douyin

While WeChat remains a powerful platform, there are a couple of platforms that have had impressive growths. These are Douyin and Red (also known as Xiaohongshu or Little Red Book), which have both experienced significant growth among Chinese consumers in New Zealand, reflecting broader global trends.

Douyin, the Chinese and original version of TikTok, is a prominent app used to share short-form video content. Douyin allows users to create and share short, entertaining videos with a wide range of creative tools and effects. In 2022, Douyin has witnessed the highest growth rate amongst social media platforms in China, with 72.3% of internet users utilising it monthly. Source: GWI data (see FIG 2 above). This makes it the second most widely used form of media in Chinese and a very influential channel for marketing purposes. Furthermore, one third of Douyin’s monthly users in 2023 are under the age of 26, giving the platform significant opportunity to reach younger generations (Source: Hicom)

A key difference between the use of these digital apps in New Zealand and China is the availability of other Western platforms to users here in Aotearoa. Chinese in New Zealand also engages with popular platforms such as YouTube, Instagram, Facebook, Tik Tok and Google Business profiles. Since there is no available research on this topic here in New Zealand, we can only guess that Chinese people living here would use Douyin if they are most familiar and comfortable with Mandarin. However, it is also possible that they use Tik Tok as the content provided by Tik Tok is more relevant to life in NZ.

Red (Xiaohongshu)

Xiaohongshu, also known as “Little Red Book” or “Red,” is another prominent social e-commerce platform in China. According to GWI data Red has seen a substantial increase in monthly usage, reaching 49.5% of internet users aged 16-24 using the app monthly in 2022 (see FIG 2 above). It combines social media, content creation, and online shopping into a cohesive user experience where users can share their experiences, reviews, and recommendations on various topics.

Red has become an influential platform for consumer insights and brand discovery, allowing users to explore trends, engage with communities, and often influences significant life decisions and day-to-day purchases.

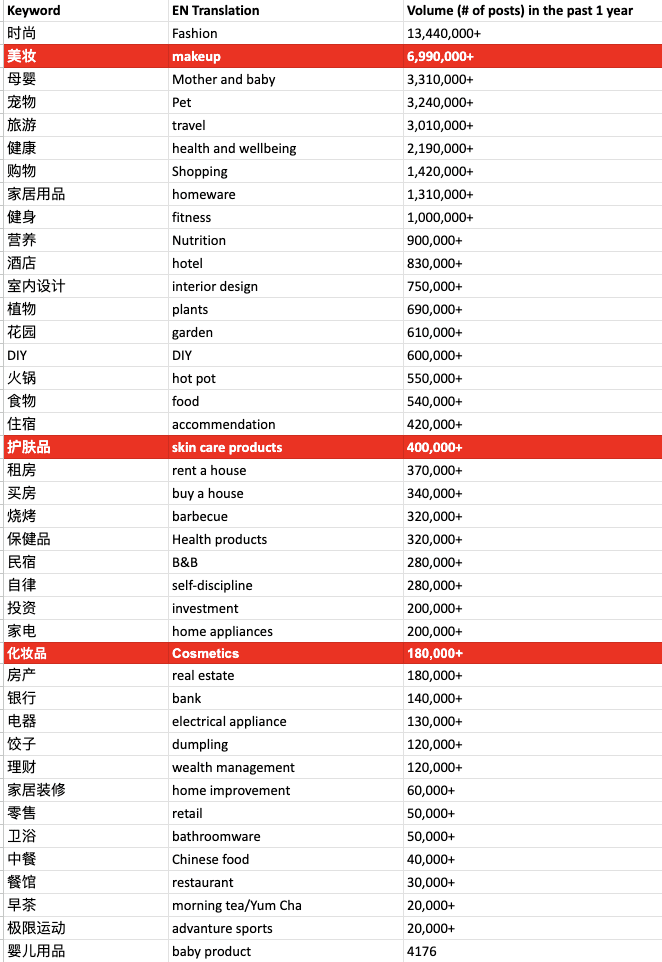

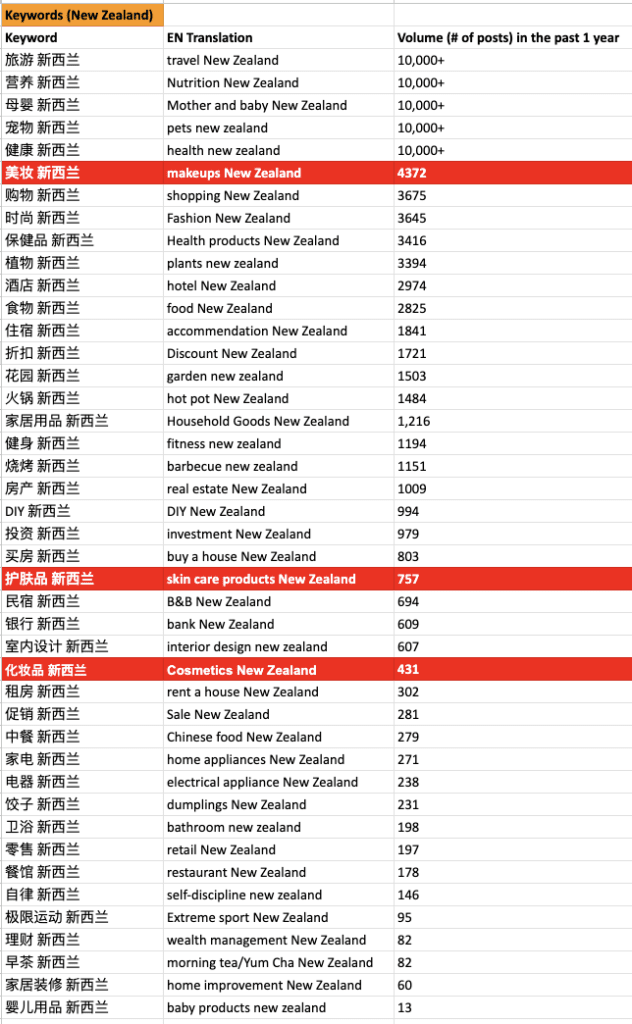

The trend of growth in popularity for Red is mirrored in New Zealand. This platform is where KOL (Key Opinion Leaders or Influencers) and KOCs (Key Opinion Customers) post their reviews and feedback and has become a key discovery platform in NZ. Figure 4 below shows the volume and range of content shared on Red as at 28 Feb 2023. (Source: app.qian-gua.com)

Using the beauty keywords as an example, the keyword “makeup” had almost 7 million associated notes (i.e. posts) on Red in the last 12 months. Other related keywords include “skin care products” has over 400,000 notes and “cosmetics” with over 180,000 notes.

FIG 4:

If the same keywords are narrowed to include ‘NZ’ in it, the volume of notes in the last 12 months (ending 28 Feb 23) regarding the topic ‘Makeup NZ’ reduces to 4372; ‘Skincare Products NZ’ is 757 and ‘Cosmetics NZ’ is 431 (FIG 5).

This is still a significant amount of notes/ posts for NZ that indicates the level of activity in NZ especially when some of the highest viewed posts can reach over a million views (source: Red s at 15 June 2023 for keyword Makeup NZ)

FIG 5:

Too many figures and percentages? Just go right to the end of this article and you’ll find the key findings summarised for you!

The Rise of KOLs and KOCs

KOCs (Key Opinion Customers) and KOLs (Key Opinion Leaders) are two important terms in Chinese social media marketing that refer to individuals who can have a significant impact on brand promotion and consumer behaviour. They are basically different levels of influencers with KOCs describing nano or micro influencers.

As at Sept 2022, it is estimated to be 10.1 million KOLs and KOCs across China’s social media ecosystem with a fan base of over 10,000 followers (Source: China’s National Bureau of Statistics). This level of influence has great potential to influence purchasing decisions which is reflected in the massive growth of the influencer economy in China. In China, the influencer economy grew from RMB 241.9 billion ($38.5 billion) in 2018 to RMB 1.3 trillion ($210 billion) in 2020, and estimated that by 2025, to reach RMB 6.7 trillion ($1.035 trillion) (Source: China’s National Bureau of Statistics)

Key Opinion Customers (KOCs) are often everyday consumers who have a genuine passion for a specific niche or industry. They have a small to moderate following on social media platforms and are considered experts or enthusiasts in their respective fields. KOCs are known for their authentic and relatable content, which resonates with their followers. They often have a closer and more engaged relationship with their audience compared to macro-influencers or celebrities.

Key Opinion Leaders (KOLs) are individuals who have established themselves as authoritative figures or experts in a particular industry or field, often celebrities or well-known personalities. They have a substantial following on social media platforms and possess the ability to influence consumer opinions and purchasing decisions. They collaborate with brands to endorse products or services, leveraging their expertise and credibility to drive engagement and conversions. The influence of these KOLs have been growing with a conversion rate of Chinese KOLs growing by almost 40% between January and May 2020 (Source: The Drum)

In NZ, with a platform that thrives on reviews and user-generated content, there is a large group of KOCs and KOLs that are active. With the impact of KOLs and KOCs on a brand visible on Red, we would predict that the importance of KOL/KOC marketing will only grow in NZ as a way to reach and influence the Chinese living here.

Video Consumption and Engagement:

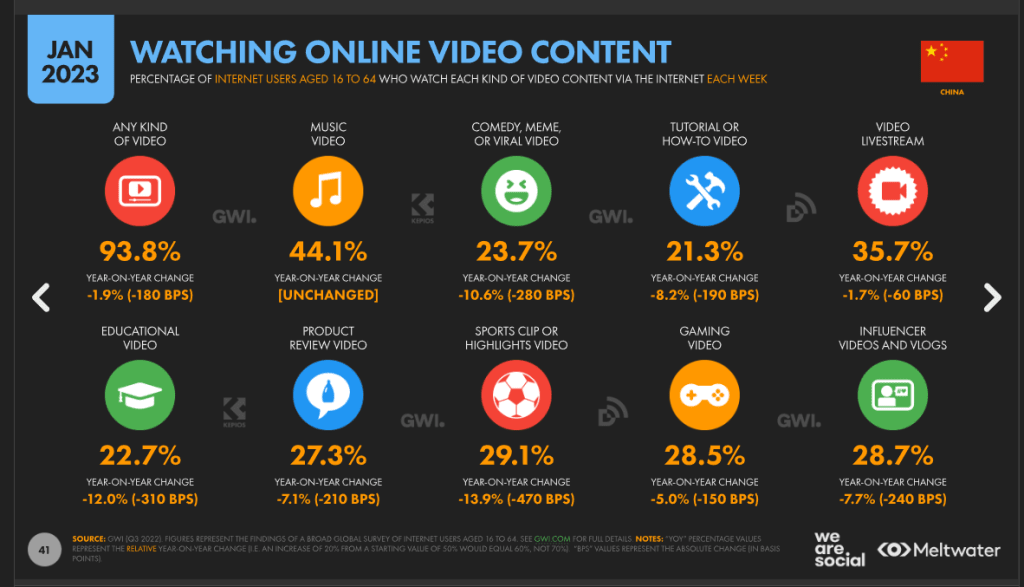

It is clear that in both China and New Zealand the consumption of video content is a popular past-time with internet users. In China 93.8% of internet users consume some form of video content on a regular basis (See FIG 6) (Source: GWI 2023)

FIG 6:

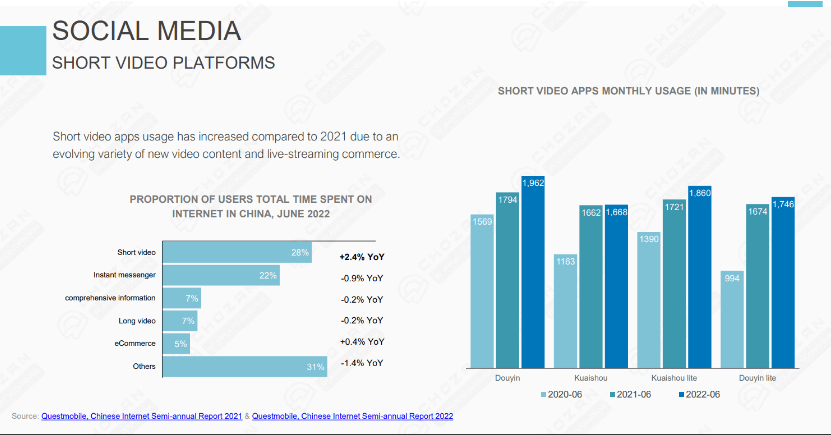

According to Questmobile, the time spent on short videos has risen by 2.4% in 2022 to reach 28% compared to the previous year (see FIG 7).

FIG 7:

The main difference between those here in NZ and in China is the platforms where these videos are consumed. For the Chinese, video is consumed within WeChat, Red, Douyin as well as other key apps build with Mandarin being the main language. WeChat’s video channel and live streaming have particularly experienced remarkable growth, with total views of original content increasing by 350% year on year. Live streaming and broadcasts on WeChat have also seen a 300% increase year on year. (Source: developers.weixin.qq.com)

Similar to the trend that is occurring in the English-speaking world, video consumption and effectiveness is still growing quickly and cannot be ignored. To effectively reach Chinese consumers, businesses should consider incorporating video content and where possible, consider leveraging live streaming opportunities across Chinese-based platforms such as WeChat, Weibo, Douyin, and Red.

So what does all this mean?

You’ve probably had enough of figures and stats by now. However, please let me summarise the key points for you:

- Although the growth of WeChat has slowed, the outlook is for WeChat to continue as the dominant platform for Chinese whose first language is Mandarin, living in China and abroad.

- The digital landscape for the Chinese is changing with the rising popularity of video channels Douyin and Red, focusing on User Generated Content.

- Similar to video trends seen in the English-speaking digital ecosystem, the shift towards video-centric content is also happening in the Chinese ecosystem.

- We observe this is also happening in the impact of influencers on consumers and the growth of user-generated content (UGC).

- The key difference for the Chinese is the channels: The go-to platforms for Chinese are WeChat, Douyin, Weibo and Red while for English speakers they are platforms such as Facebook, Instagram and Tik Tok.

- In NZ, Red has become the go-to platform to discover product reviews, user experience and recommendations. We predict that this trend will continue to grow. Brands are now finding the impact of KOLs and KOCs posts (notes) on brands is making a noticeable difference.

Congrats on making it to this point! Hopefully, this isn’t information overload for you! If it is, please contact one of our Marketing Consultants at Marketing Minds, your award-winning digital marketing agency in Auckland to see how we can assist. From conducting research into WeChat and Red platforms to social listening and managing Official brand accounts, our team of Marketing Consultants will know what to do!

______________________________________________________________________________________

Your business could qualify for partial government grant with Marketing Minds Digital Marketing Success programme.

If you want some more personalised advice on reaching your marketing objectives, or if you have any other questions, call us at +64 9 6344 390, email info@marketingminds.me or contact us.

Enjoyed this article and want more? Sign up now to our marketing snippets!

If you’ve found this article useful, please share it with others.